|

New Stranger Originated Life Insurance (STOLI) Legislation (and Best-Practices)

On June 12, 2008, Ohio Governor Ted Strickland signed into law a bill that was written in an effort to end stranger originated life insurance (“STOLI”). Under the new law, Ohio’s Department of Insurance will have more authority over life settlements, and life settlement brokers and providers are required to give insurers more information before engaging in a life settlement. Life insurers will have to ask specific questions that are designed to uncover STOLI transactions and suspected STOLI transactions have to be reported to the department.

Ohio’s law also limits the ability of policyholders who use certain types of premium financing arrangements from selling their life insurance policy within five years of buying the policy. This restriction on the sale of a policy during the first five years does not apply to a policyholder who has experienced a life-changing event, such as illness, unemployment, or the death of an intended beneficiary. The adoption of this legislation is the latest in what is almost certain to be increased regulation of the life insurance, life settlement, and premium financing markets.

However, most States have yet to adopt any type of STOLI legislation. Until such consumer protections are more widespread, financial advisors can play a valuable role in determining the suitability of such transactions and/or protecting clients from the marketers of transactions that are not suitable. While STOLI transactions are often marketed simply as “free insurance” or a safe and simple way to “monetize the wasting asset that is the clien t’s insurability”, STOLI is effectively a "mortality futures" transaction but even more complicated than most “futures” transactions. t’s insurability”, STOLI is effectively a "mortality futures" transaction but even more complicated than most “futures” transactions.

As with all "future" transactions, there is considerable risk. To help clients understand and evaluate the risk factors inherent in the STOLI transaction, click here to download a FREE White Paper that discusses the economics and viability of the STOLI transaction and includes the top-10 due diligence questions to ask for any client considering a STOLI transaction (see page 63). Also, while STOLI transactions may come “pre-packaged” with a given insurance product, a given lender and a given life settlement market maker, transaction risks can be reduced by using THEInsuranceAdvisor.COM research to investigate the suitability of the underlying life insurance product.

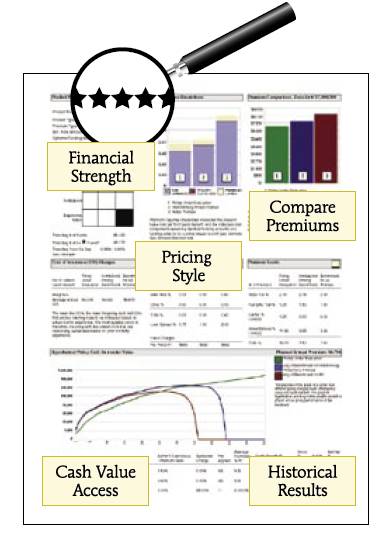

Use the Confidential Policy Evaluator (CPE) Research Reports to determine the appropriateness of pricing, the reasonableness of performance expectations for invested assets underlying policy cash values, and overall suitability for your clients' policies based on the 5 factors of suitability. Click here and get up to 3 Confidential Policy Evaluator (CPE) research reports under our NO-RISK trial subscription.

|